Value Added Tax (VAT)

Value Added Tax or VAT is a tax on the consumption or use of goods and services. A VAT of 5 per cent is levied at the point of sale. Businesses collect and account for the tax on behalf of the government. Learn how to register for VAT (value added tax) and how to file VAT returns in the UAE.

About VAT

Value Added Tax (VAT) was introduced in the UAE on 1 January 2018. The rate of VAT is 5 per cent. VAT will provide the UAE with a new source of income which will be continued to be utilised to provide high-quality public services. It will also help government move towards its vision of reducing dependence on oil and other hydrocarbons as a source of revenue.

Read more about VAT on the website of Ministry of Finance.

VAT guidelines:

- VAT treatment for selected sectors (PDF, 218 KB)

- VAT for businesses (PDF, 2.6 MB)

- VAT for education (PDF, 1.81 MB)

- VAT for retailers (PDF, 6.09 MB)

- Guidance on zero-rated and exempt supplies (PDF, 1.44 MB)

- 10 things you need to know about VAT (PDF, 1.64 MB)

- VAT treatment of properties (PDF, 2.63 MB)

- VAT treatment for imported goods (PDF, 336 KB)

- Know your rights - Tax invoice (PDF, 4 MB)

- Know your rights – Education (PDF, 140 KB)

- Know your rights – Healthcare services (PDF, 139 KB)

Check more guides, references and public clarifications from the Federal Tax Authority.

View VAT laws on the website of Federal Tax Authority.

Useful links:

- Federal decree-law No. 8 of 2017 on value added tax (PDF, 1 MB)

- UAE Cabinet Decision 52 of 2017 on the executive regulations of the Federal Decree Law No. (8) of 2017 on Value Added Tax

- Federal law by decree No. 13 of 2016 concerning the establishment of Federal Tax Authority (PDF, 1.5 MB)

- VAT FAQs - Federal Tax Authority

Criteria for registering for VAT

It is mandatory for businesses to register for VAT in the following two cases:

- If the taxable supplies and imports of a UAE-based business exceed AED 375,000 per annum

- If a non UAE-based business makes taxable supplies in the UAE, regardless of its value, and there is no other person obligated to pay the due tax on these supplies in the UAE.

Meanwhile, VAT is optional for businesses whose supplies and imports exceed AED 187,500 per annum.

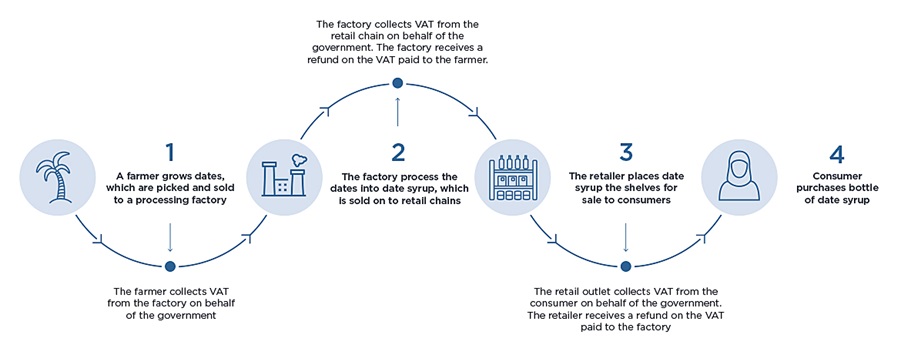

A business house pays the government, the tax that it collects from its customers. At the same time, it receives a refund from the government on tax that it has paid to its suppliers.

Foreign businesses may also recover the VAT they incur when visiting the UAE.

Read more on VAT registration:

How to register for VAT?

Businesses can register for VAT through the eServices section on the FTA website. However, they need to create an account first.

For general queries about tax registration and/or application, you may contact Federal Tax Authority through the 'Contact us' page.

How is VAT collected?

VAT-registered businesses collect the amount on behalf of the government; consumers bear the VAT in the form of a 5 per cent increase in the cost of taxable goods and services they purchase in the UAE.

UAE imposes VAT on tax-registered businesses at a rate of 5 per cent on a taxable supply of goods or services at each step of the supply chain.

Tourists in the UAE also pay VAT at the point of sale.

On which businesses does VAT apply?

Certain free zones have been specified as designated zones for VAT purposes. While special rules apply to supplies made in the designated zones, the businesses established in such zones may still need to register for VAT provided the criteria for registration is met.

Filing a return for VAT

At the end of each tax period, VAT registered businesses or the ‘taxable persons’ must submit a ‘VAT return’ to Federal Tax Authority (FTA).

A VAT return summarises the value of the supplies and purchases a taxable person has made during the tax period, and shows the taxable person’s VAT liability.

Liability of VAT

The liability of VAT is the difference between the output tax payable (VAT charged on supplies of goods and services) for a given tax period and the input tax (VAT incurred on purchases) recoverable for the same tax period.

Where the output tax exceeds the input tax amount, the difference must be paid to FTA. Where the input tax exceeds the output tax, a taxable person will have the excess input tax recovered; he will be entitled to set this off against subsequent payment due to FTA.

How to file VAT return?

You must file for tax return electronically through the FTA portal: eservices.tax.gov.ae. Before filing the VAT return form on the portal, make sure you have met all tax returns requirements.

When are businesses required to file VAT return?

Taxable businesses must file VAT returns with FTA on a regular basis and usually within 28 days of the end of the ‘tax period’ as defined for each type of business. A ‘tax period’ is a specific period of time for which the payable tax shall be calculated and paid. The standard tax period is:

- quarterly for businesses with an annual turnover below AED150 million

- monthly for businesses with an annual turnover of AED150 million or more.

The FTA may, at its choice, assign a different tax period for certain type of businesses. Failure to file a tax return within the specified time frame will make the violator liable for fines as per the provisions of Cabinet Resolution No. 40 of 2017 on Administrative Penalties for Violations of Tax Laws in the UAE (PDF, 1 MB).

Watch this video to learn how to file a VAT return.

Watch this video to see how you pay your VAT liability.

Implications of VAT

Implication of VAT on individuals

VAT, as a general consumption tax, will apply to the majority of transactions in goods and services. A limited number of exemptions may be granted.

As a result, the cost of living is likely to increase slightly, but this will vary depending on an individual's lifestyle and spending behaviour. If an individual spends mainly on those things which are relieved from VAT, he is unlikely to see any significant increase.

The government will include rules that require businesses to be clear about how much VAT an individual is required to pay for each transaction. Based on this information, individuals can decide whether to buy something.

Implication of VAT on businesses

Businesses will be responsible for carefully documenting their business income, costs and associated VAT charges.

Registered businesses and traders will charge VAT to all of their customers at the prevailing rate and incur VAT on goods/services that they buy from suppliers. The difference between these sums is reclaimed or paid to the government.

VAT-registered businesses generally:

- must charge VAT on taxable goods or services they supply

- may reclaim any VAT they have paid on business-related goods or services

- keep a range of business records which will allow the government to check that they have got things right.

VAT-registered businesses must report the amount of VAT they have charged and the amount of VAT they have paid to the government on a regular basis. It will be a formal submission and reporting will be done online.

If they have charged more VAT than they have paid, they have to pay the difference to the government. If they have paid more VAT than they have charged, they can reclaim the difference.

VAT in GCC

The UAE coordinates VAT implementation with other GCC countries because she is connected with them through 'The Economic Agreement between the GCC States' and 'The GCC Customs Union'.

Read Common VAT Agreement of the States of the Gulf Cooperation Council (GCC) (PDF, 200 KB).