Economic support of Dubai government

Dubai Government and free zone authorities launched several initiatives to reduce the financial burden on businesses. Initiatives included cancelling AED 50,000 bank guarantee or cash required to undertake customs clearance activity and issuing 50 per cent refunds to non-beach hotels and their restaurants on the hotel sales fee and the Tourism Dirham fee.

Dubai economic stimulus package

Dubai Government launched an AED 1.5 billion economic stimulus package for the next three months to support companies and the business sector in Dubai. The package seeks to enhance liquidity and reduce the impact of the current global economic situation.

The stimulus package developed by Dubai Government includes 15 initiatives focused on the commercial sector, retail, external trade, tourism and the energy sector. The package is expected to have a direct and indirect positive impact on all other sectors as well, over the next three months.

For the commercial and business sector, Dubai Government has introduced nine initiatives over the next three months including a freeze on the 2.5 per cent market fees levied on all facilities operating in Dubai. The fees were reduced from 5 per cent to 2.5 per cent in June 2018. The second initiative extends a refund of 20 per cent on the custom fees imposed on imported products sold locally in Dubai markets.

The package also includes the cancellation of the AED 50,000 bank guarantee or cash required to undertake customs clearance activity. Bank guarantee or cash paid by existing customs clearance companies will be refunded. Furthermore, fees imposed on submitting customs documents of companies will be reduced by 90 per cent.

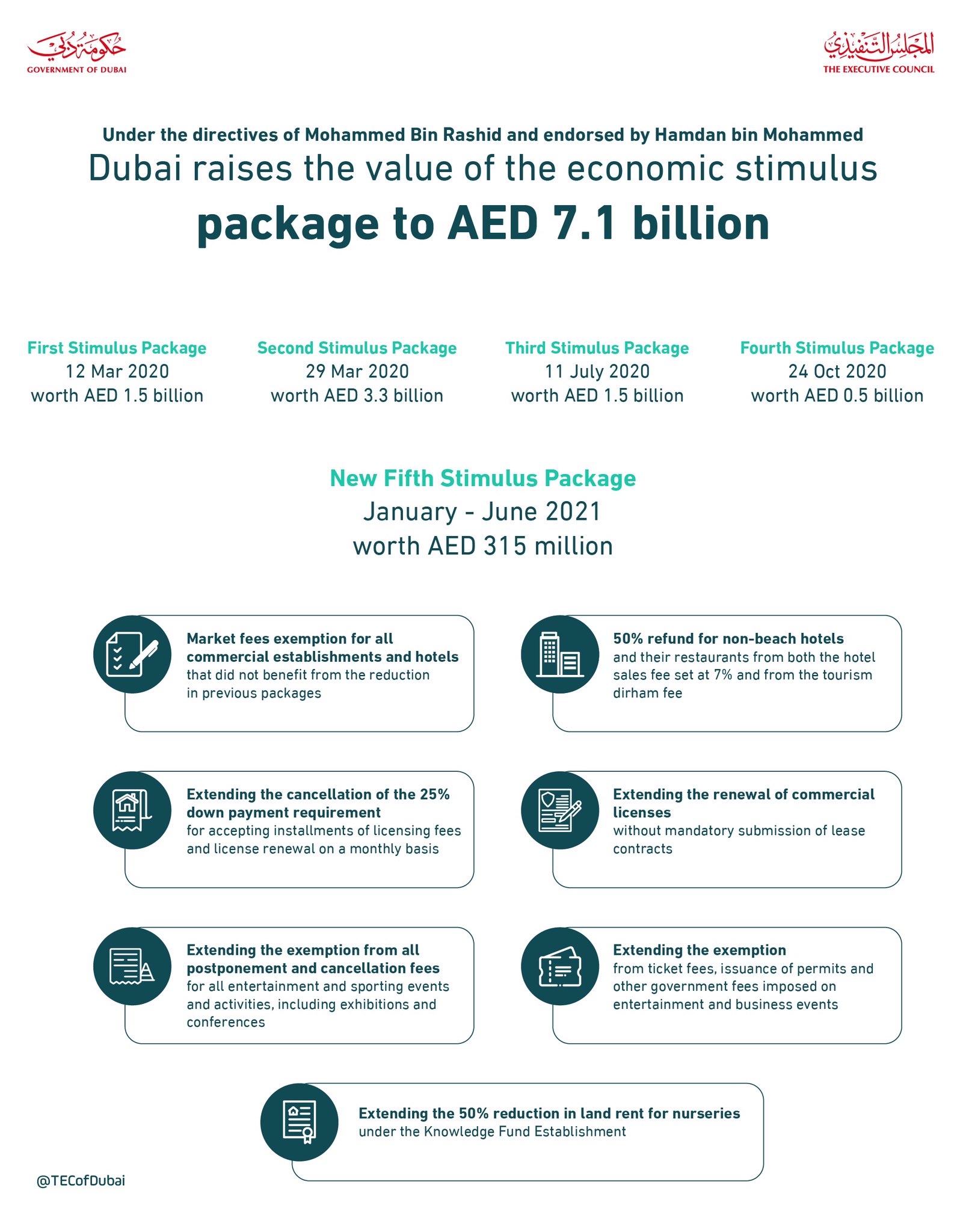

Increase of economic stimulus package to AED 7.1 billion

In January 2021, the Dubai Government launched an economic stimulus package worth AED 315 million, raising the value of business incentives introduced by the emirate’s government to AED 7.1 billion. The new package extends the validity of some of the initiatives announced in the previous stimulus packages until June 2021.

The initiatives included in the new stimulus package include:

- exempting commercial establishments and hotels that did not benefit from the reduction in previous packages from paying the market fees one time during 2021

- issuing 50 per cent refunds to non-beach hotels and their restaurants on the hotel sales fee and the Tourism Dirham fee

- continuing the decision to exempt establishments in the tourism, entertainment and events sector, from paying charges for postponement and cancellation of recreational and sports events and activities, including conferences and exhibitions

- continuing the freeze on fees charged for selling tickets and issuing permits, and other government fees imposed on entertainment and business events

- continuing to allow renewal of commercial licences without renewing lease contracts

- continuing the cancellation of the requirement of 25 per cent down payment for accepting installments of licensing fees and licence renewal every month

- continuing the decision to reduce the land rent by 50 per cent for nurseries that are leasing land from Knowledge Fund Establishment.

Read related news coverage on WAM.

Follow related social media post on Twitter.

Relief package for bank customers

Banks in Dubai have come together to offer a comprehensive relief package to ease the financial pressure on their customers in the current economic environment caused by the coronavirus (COVID-19) outbreak. Banks that are providing relief to their customers include Emirates NBD, Dubai Islamic Bank, Emirates Islamic, Mashreq and Commercial Bank of Dubai.

The measures announced by the banks complement the UAE Government and the UAE Central Bank’s six-month economic stimulus package to support the business sector in the UAE and the Dubai Government’s three-month economic stimulus package to support the business sector in Dubai particularly.

The relief benefits include but are not limited to the following:

- customers using credit cards for cash withdrawals will enjoy 50 per cent reduction in the cash advance charges

- credit card holders can avail zero per cent easy payment plans on school fee transactions with zero processing fee

- credit cardholders can benefit from special pricing on easy payment plans, cash on call and zero per cent on balance transfers

- card holders can request refunds on foreign currency charges related to travel and hotel cancellations

- customers who are financially-impacted (due to unpaid leave or any other valid reason) can request to defer up to 3 monthly installments without fees and profit charges on existing and new finance facilities

- customers can request for debt consolidation solution

- first-time home buyers can get 5 per cent more financing (up to 85 per cent for UAE Nationals and up to 80 per cent for expatriates)

Dubai Free Zones economic stimulus package

Dubai Free Zones Council announced an economic stimulus package to complement the Dubai Government’s efforts to overcome the COVID-19 situation. This initiative complements another package announced earlier to reduce business costs and enhance financial liquidity of companies operating in the free zones.

Dubai Free Zones Council’s package contributes to strengthening and supporting Dubai’s businesses by reducing the impact of the spread of COVID-19 on the economic situation. It includes five key elements. They are:

- postponing rent payments by a period of 6 months

- facilitating installments for payments

- refunding security deposits and guarantees

- cancelling fines for both companies and individuals

- permitting temporary contracts that allow the free movement of labour between companies operating in the free zones to continue for the rest of the year.

Furthermore, companies will enjoy additional facilities, such as the postponing of payment plans for all commercial properties owned by DIFC Investments for a period of 6 months. DIFC will reduce its ownership transfer fees from 5 per cent to 4 per cent for any property sale that occurs within the period from April to June.

Related links

DAFZA’s incentive packages

Dubai Airport Free Zone Authority (DAFZA) launched a set of economic incentive packages to support companies based in the free zone, in order to ensure business continuity across various sectors. The incentive packages aim to help the businesses mitigate the severity of the economic impact caused by COVID-19.

The initiative includes postponing lease payments for up to three months and facilitating financial payments into easier monthly instalments. It supports retailers also who are operating from the free zone by exempting them from lease payments for a period of up to three months. The free zone would refund security deposits on leased spaces and labour guarantees to companies, as well as exempt new companies from registration and licensing fees. DAFZA would also cancel fines issued to companies.

Read related news coverage on WAM.

Dubai’s third economic stimulus package

Under the directives of H. H. Sheikh Mohammed bin Rashid Al Maktoum, Vice President and Prime Minister of the UAE and Ruler of Dubai, Dubai Government launched a third stimulus package to ease the impact of the COVID-19 crisis on businesses. The stimulus package aims to support small and medium enterprises and a number of strategic sectors maintain business continuity by reducing operational costs.

Worth AED 1.5 billion, the new package raises the value of business incentives by the government in the past few months to AED 6.3 billion. The first stimulus package was worth AED 1.5 billion and the second was worth AED 3.3 billion.

New initiatives

The government launched many initiatives to support business sectors across the economy. Below are some of the initiatives in various sectors.

In the healthcare sector

- ensuring its payments to private hospitals are expedited.

In the tourism and entertainment sector

- extending the period for offering refunds of 50 per cent on municipality fees to hotel establishments and restaurants, from July to December 2020

- halving the ‘Tourism Dirham’ fee until the end of the year

- extending the decision to freeze the collection of fees for hotel rating, ticket sales, permits and other government services related to entertainment and business events.

In the international trade sector

- reducing fines for some customs cases by 80 per cent and providing the option to pay in instalments.

In the construction sector

- expediting the payment of financial dues to contractors

- refunding all financial guarantees for construction activities related to commercial licences.

In the education sector

- exempting private schools from commercial and educational licence renewal fees until the end of the year.

Extension of some initiatives from the first package

The current stimulus package includes extending the validity of some of the initiatives announced in the first stimulus package for three months until the end of September 2020 to support the private sector in recovering from the crisis. The initiatives include:

- freezing the collection of the 2.5 per cent market fee

- cancelling all fines for late payment of government service fees

- cancelling the payment of penalties to renew commercial licences

- renewing commercial licenses without renewing lease contracts

- cancelling the requirement to make a down payment of 25 per cent fees of government services

- exempting businesses from fees for discounts and special offers.

In the international trade sector

- extending the exemption of traditional commercial vessels registered locally in the UAE from paying docking fees at Dubai Port and Hamriya Port

- waiving AED 50,000 bank or cash guarantee to conduct customs clearance activity

- refunding bank and cash guarantees paid by customs clearance companies

- reducing the fees on customs documents from AED 50 to AED 5 for each transaction and accelerating the processing of customs complaints.

Image source: Dubai Media Office

Read news coverage on WAM and Dubai Media Office.